The First Encounter: All About "T Accounts"

- Oct 26, 2016

- 2 min read

This meeting marks the start of our second quarter. I was fairly satisfied with my performance during the first quarter based on the grades that I have received. I think that my grade in the PT was already good in its own way as at least I did not fail despite the difficulty that I have faced. Given that, I hope that I could be better this quarter as I am hoping to improve myself and be a great bookkeeper in the future.

But still that future is still far ahead of me and there are still a lot of things that I am still not aware of. One example of those things are the "T accounts". I have heard of it before since my older brother is studying accounting and I saw it in some of his books but other than that, I am completely unaware of what it is.

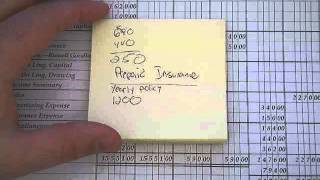

Discussion went and I finally realized what T account really is. It is something like the ledger and yet so different in terms of its format. If in the ledger I am obliged to use the 2 column worksheet, in the T accounts, any paper would do. And also for the T accounts, there is something like a big "T" on the top of the "T" you write the account title, the debit amounts on the left and the credit on the right. So all the information in a ledger could also be seen in the T accounts. Aside from that, Sr. Randy said that he isn't that strict regarding the T accounts so I may have many erasures and not have and deduction from it which is why from now on I prefer T accounts compared to the ledger.

After the discussion we did a T account and a trial balance of the PT. Since I got something wrong with my PT, I still need to correct it before proceeding so I got a bit late in starting compared to others. When I was actually doing the T accounts I had my own method compared to what Sr. Randy showed us. I first wrote down all the amounts under cash before proceeding to the next account title so that I wouldn't bother flipping pages if I would go from assets to owner's equity or liabilities. Even while using my own method, I was able to finish everything on time from the T accounts to the trial balance. Although I got a bit of correction in my paper, but since I only realized my mistake last minute and I wouldn't want to waste paper, I simply lined and signed it, implying that I accepted my mistake.

This concludes my first encounter with the T accounts.

Comments