The Perfect Recipe for an 8 Column Worksheet

- Feb 22, 2017

- 3 min read

I’ve been into baking these days. They say that in baking, in order to have a perfect cake, you need to have the right amount of ingredients and follow the procedures thoroughly. But as much as I love baking, I can’t ignore bookkeeping. I realized that bookkeeping is somehow just like baking at some aspects.

How to have a perfect 8 column worksheet

Ingredients:

Ruler. Best if it is 12 inches long or more. You’ll never be sure of the row you’re writing on without a ruler.

Ball pen. Make sure that it has a vivid black ink which does not smudge nor make mistakes yes, it is the pen that makes the mistake not you. Blame the pen (Palestina, 2016).

Calculator. For the long additions and subtractions. Make sure they're trustworthy, all the total amounts depend on their abilities

Fast and Reliable Hands. In case of emergency where there is only 5 minutes left and you still have to rewrite the whole worksheet.

Clear and Focused Mind. For an accurate writing, don't let your mind fliy.

Determination. JUST GO FOR IT!!!!

Big clock to show you the exact time and put you under big pressure. Pressure is the greatest motivation.

Directions:

Write the heading of the document: first line: NAME OF THE BUSINESS (ALL CAPS), second line: Worksheet, third/last line: “ For the period/month/quarter (it depends on the periodicity of the business) ended Month Day, Year.

Label each column. The widest column would be the PARTICULARS Column, Column 1 and 2 would be the Trial Balance Column, Column 3 and 4 would be the Cost of Sales Column, Column 5 and 6 would be the Income Statement Column, while Column 7 and 8 would be the Balance Sheet Column.

*Take note that all the odd numbered columns (1,3,5,7) would be meant for the debit amounts, while the even numbered columns (2,4,6,8) would be for the credit amounts.

Get the amounts of each account titles from the ledger balances (T-accounts) and put it under the “Trial Balance Column”. Then Balance the debit and credit out.

The Cost of Sales Column would contain the amounts from the accounts: Merchandise Inventory Beginning (Dr), Purchases (Dr), Purchase Related Accounts (Cr) Freight in (Dr) Merchandise Inventory Ending (Cr). Equate all the amounts from the debit and credit column then subtract the smaller amount from the bigger one. Usually, the credit is smaller than the debit. Add the difference of the two to the smaller amount to balance them out. Label the difference of the debit and credit as Cost of Sales in the Particulars Column.

The Income Statement Column would contain the amounts from the accounts: Sales (Cr), Sales Related Accounts (Dr), Salary and Wages (Dr), Operating Expense (Dr), Freight Out (Dr), Miscellaneous Expense (Dr), Cost of Sales (If it is debited on the Cost of Sales column, then credit it in the Income Statement, but if it is placed on the credit column of the Cost of Sales Column, debit it in the Income Statement. In short, do the opposite to it.). Equate the debit and credit column, then subtract the smaller account to the bigger amount. If credit is bigger than debit, then label the difference as Net Profit, but if it is the other way around, label it as Net Loss. Add the difference to the smaller amount to balance the Income Statement Column.

For the Balance Sheet, you just simply encode in all the remaining accounts not used in the previous columns along with the merchandise inventory ending. Although this time, the merchandise inventory ending will be debited unlike the one in the Cost of Sales column. Just put them all in their right debit and credit columns the equate them! You may notice that they are not equal but worry not! Remember the difference from the Income Statement? Just add it to the lower amount and you may notice that they are already equal, if they’re not, something must’ve been wrong so be sure to recheck.

Top them all up by making sure you've double ruled and included peso sign to all intended amounts. Remember that there should be a peso sign in every first appearance of amounts in each column and after a line used to indicate a operation that has been done.

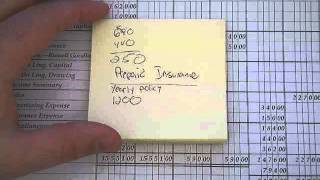

Something that truly helped me to have this recipe (aside from the lessons of Sr. Randy), is this video:

I found out this video a few days after our discussion and this video made me remember and help me review the process of preparation of an 8 column worksheet.

References:

Miguel Carmo (2015, January 7). Completing an 8 coulumn worksheet part 1 (accounting 1) Retrieved from https://youtu.be/myWxwr2Buy8

Comments